In absence of Partnership agreement interest on partner's loan/Advance will be calculated at 6% pa (5% / 6% / 8%) 14 The partner who does not participate actively in partnership business is knows as nominal (nominal / inactive) partnerQ4 Gagandeep, a partner advanced a loan of ` 60,000 to the firm on 30th November The firm incurred a loss of ` 15,000 during the year ending 31st March, 21 In the absence of partnership deed interest a loan allowed to Gagandeep will be 1 0 6 Interest on partners loan It is a charge against profits It is provided irrespective of profits or loss It will also be provided in the absence of

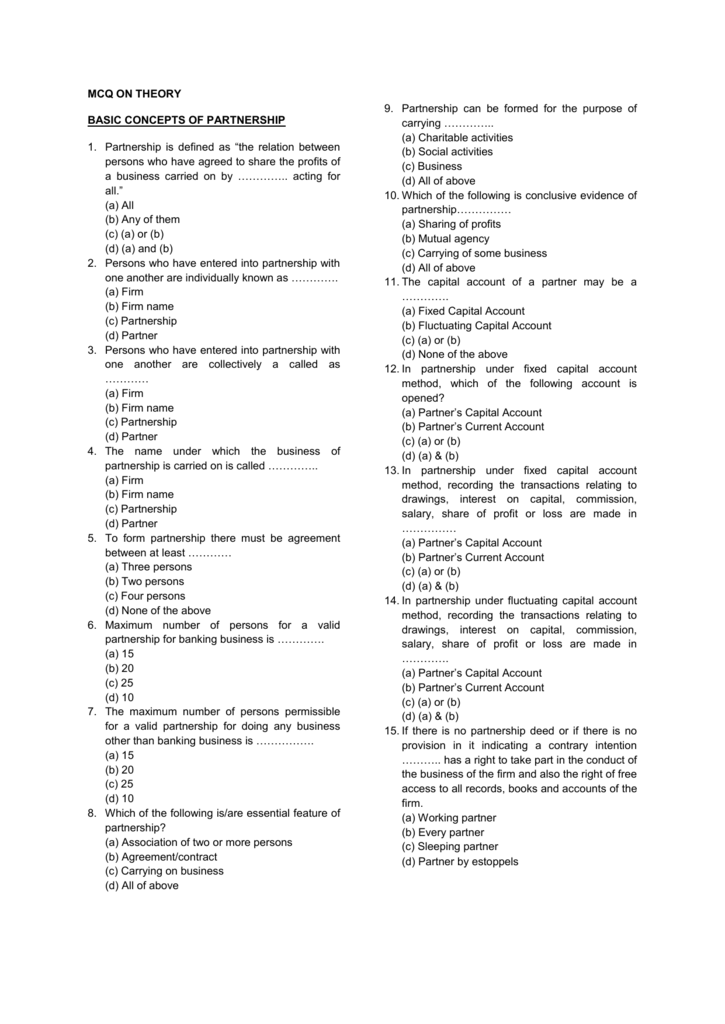

Interest On

In the absence of partnership deed interest on loan of a partner is allowed

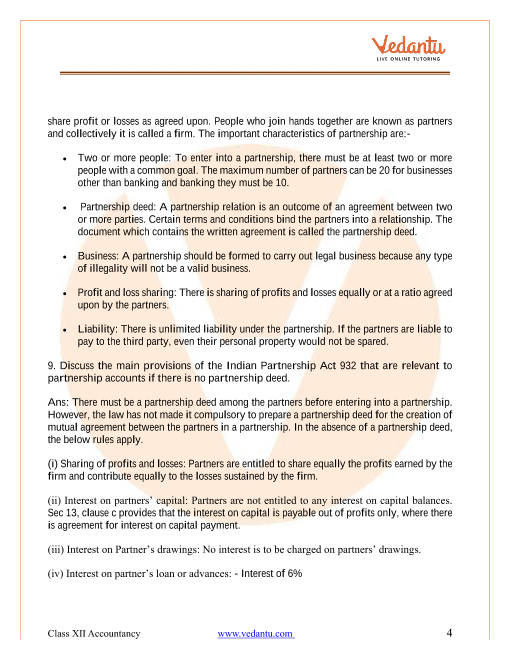

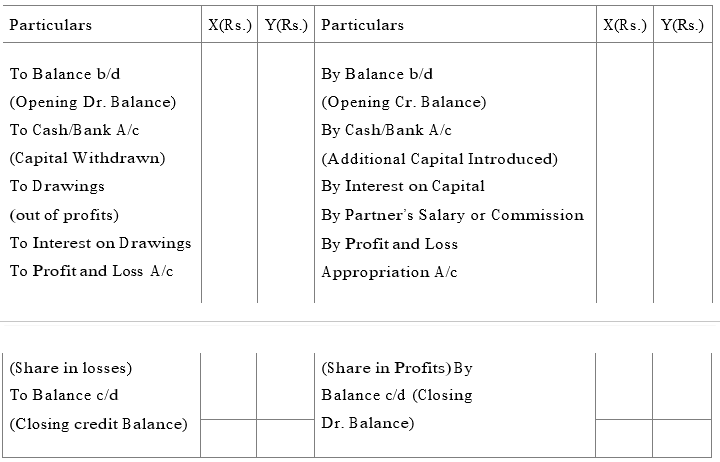

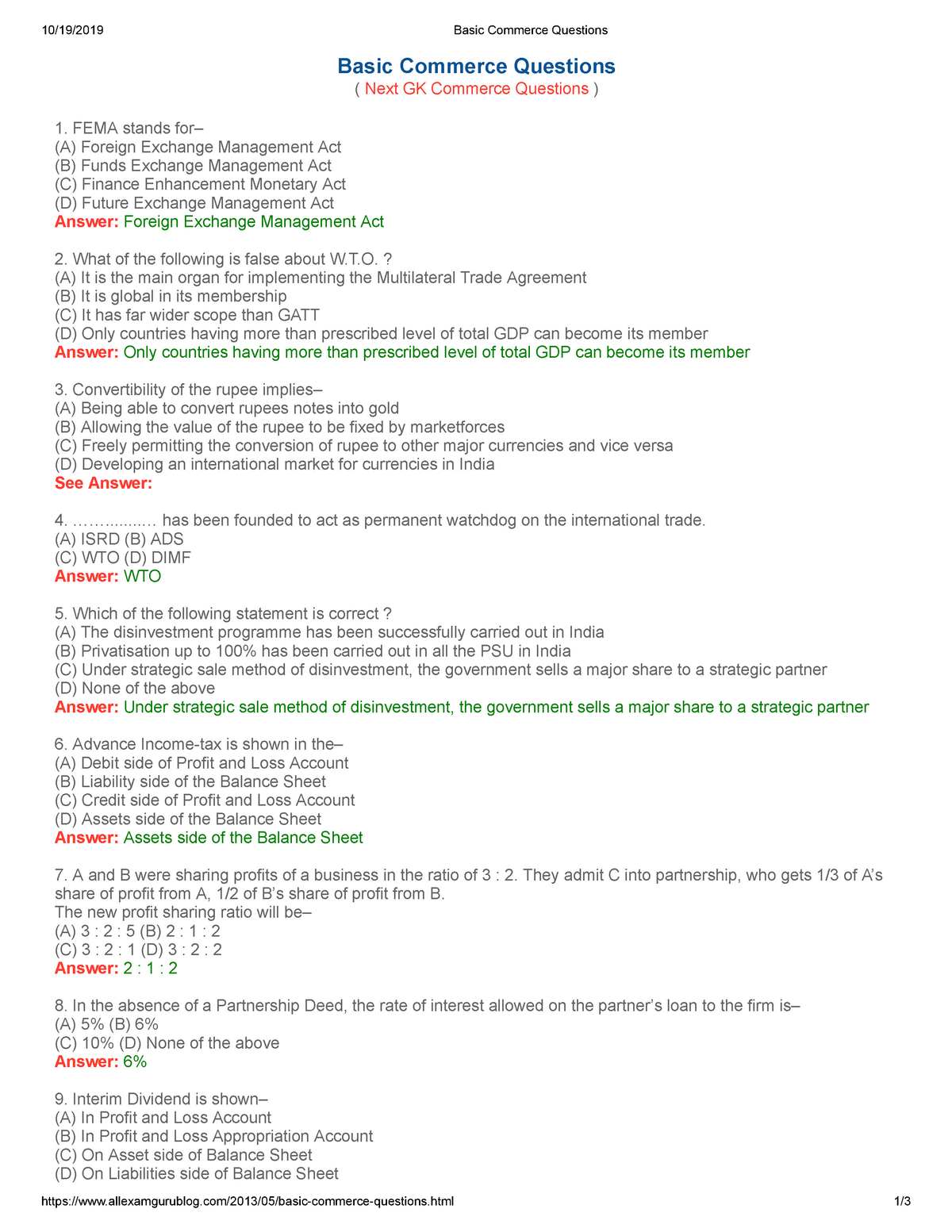

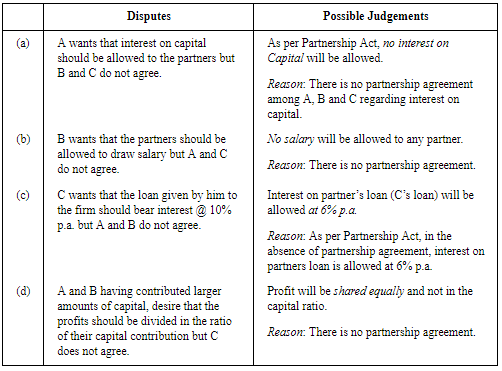

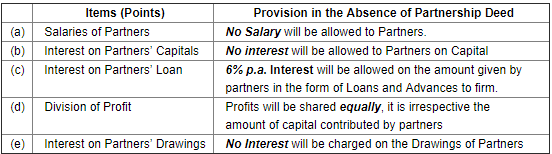

In the absence of partnership deed interest on loan of a partner is allowed- 21 In the absence of Partnership deed, partners are entitled to interest on capital F 22 Interest on loan advanced by a partner to the firm shall be paid even if there are losses in the business T 23 Under Fixed Capital method, any addition to capital will be shown in Partner's Capital AccountT 24 provision in the absence of partnership deed (a) salaries to partners No salary will be allowed to partners (b) Interest on partners No interest will be allowed to partners on their capital (c) Interest on partner loan 6% pa interest will be allowed on the money given by parters to the firm in the form of loans and advances (d

Images Topperlearning Com

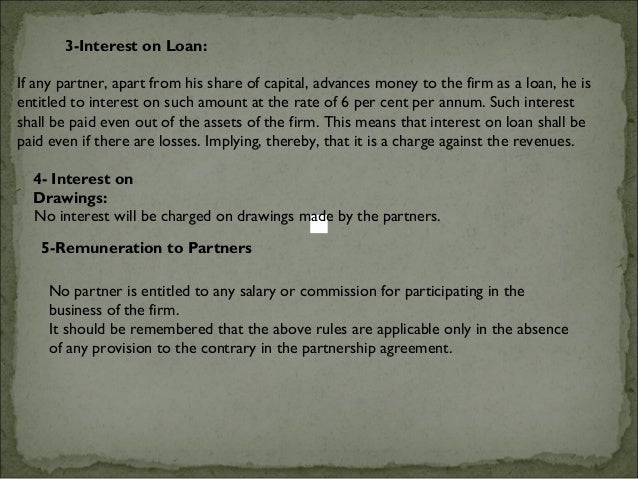

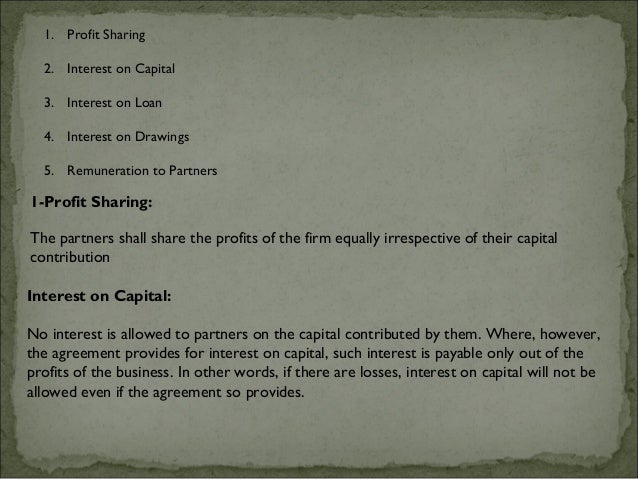

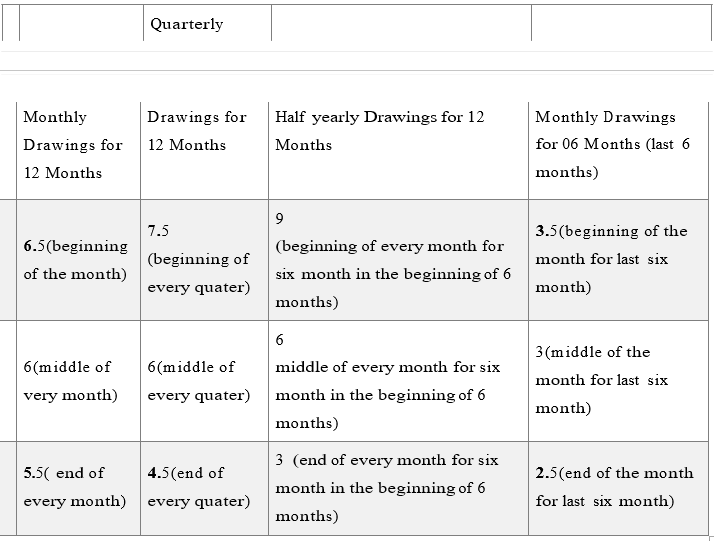

INTEREST ON DRAWINGS Partnership deed must state the rate of interest on drawings to be charged from partners RULES APPLICABLE IN THE ABSENCE OF PARTNERSHIP DEED Interest at the rate of 6% per annum is to be allowed on a partner's loan to the firm Such interest shall be paid even if there are losses to the firm 19 In the absence of a partnership deed, the allowable rate of interest on partner's loan account will be (A) 6% Simple Interest (B) 6% pa Simple Interest 12% Simple Interest (D) 12% Compounded Annually Answer Answer B In the absence of Partnership Deed , Interest on loan of a partner is allowed a) 8% per annum 2 In the absence of Partnership Deed Interest on Drawing of a partner is charged b) 9 % per annum c) 6% per annum d) No Interest is charged

The Partnership Deed provides that both Reema and Seema will get monthly salary of Rs 15,000 each, Interest on Capital will be allowed @ 5% pa and Interest on Drawings will be charged @ 10% pa Their capitals were Rs 5,00,000 eachIn the absence of Partnership Deed, what are the rules relating to a Salaries of partners, b Interest on partner's capitals, c Interest on partner's loan, d Division of profit, and e Interest on partners' drawings?Question In the absence of Partnership Deed, interest on loan of a partner is allowed (a) at 8% per annum (b) at 6% per annum (c) no interest is allowed (d) at 12% per annum

In the absence of partnership deed interest a loan allowed to Gagandeep will be (a) Rs3,600 (b) Rs900 (c) Rs 1,0 (d) Rs 1,800 35Vikas and Yogesh were in partnership sharing profits and losses in the ratio of 2 1 They admitted Kunal as a new partner 4 In the absence of partnership deed, the partner will be allowed interest on the amount advanced to the firm by him at the rate of (A) 6% (B) 6% pa 12% (D) None of these Answer 6% pa 5 In partnership firm, profits and losses are shared—(A) Equally (B) In the ratio of capitals As per Agreement (D) None of these AnswerIn the absence of Partnership Deed AInterest will not be charged on partner's drawings,BInterest will be charged @ 5% pa on partner's drawings,CInterest will be charged @ 6% pa on partner's drawings,DInterest will be charged @ 12% pa on partner's drawings

Nmfdegree Edu In

Ravi And Tiku Are Partners In A Firm According To Their Partnership Deed I Interest On Capital Will Be Allowed 5 Per Annum Sarthaks Econnect Largest Online Education Community

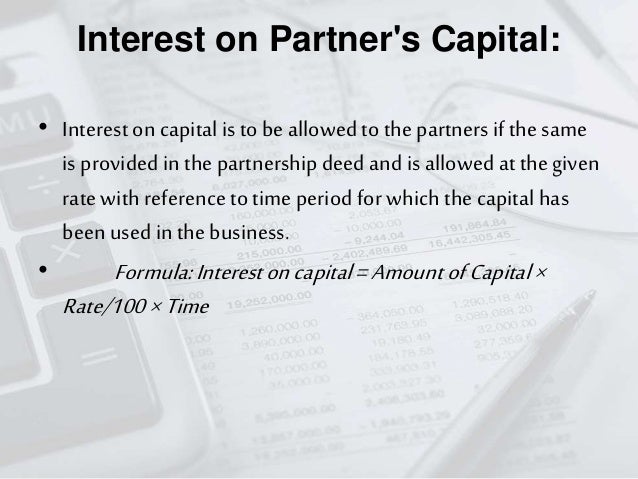

Interest on capital No interest is allowed on the capital Where a partner is entitled to interest on capital contributed as per partnership deed, such interest on capital will be payable only out of profits Section 13 (c) Interest on loans advanced by partners to the firm Interest on the loan is to be allowed at the rate of 6 percent per Assertion (A) Interest on Loan to partner is charged @6% pa If partnership Deed does not provide for the charging of interest Reason (R) In the absence of Partnership Dee, provisions of the Partnership Act 1932 apply Thus Interest on Loan to Partner should be charged @6% pa Otherwise, interest is allowed at the agreed rate of interestPartnership Deed Meaning, Clauses and Importance 23 Provisions Affecting Accounting Treatment in the Absence of Partnership Deed 24 Interest on Loan by the Partner to the firm and by the firm to the Partner 26 Distribution of Profit among Partners Profit and Loss Appropriation Account 210 Special Aspects of Partnership Accounts 221

Provisions Of Partnership Deed Indian Partnership Act 1932

Chapter 2 Distrubution Of Profits Pdf Partnership Interest

In the absence of Partnership deed, specify the rules relating to the following (i) Sharing of profits and losses (ii) Interest on partner's capital, (iii) Interest on Partner's drawings (iv) Interest on Partner's loan (v) Salary to a partner Answer (i) Sharing of profits and losses – In the absence of partnership deed, the partner will be allowed interest on the amount advanced to the firm (a) @5% (b) @6% (c) @ 9% (d) @8% Answer Answer (b) @6%June 11) (A) @ 5% pa (B) @ 6% pa @ 12% pa (D) No interest is allowed Answer Answer D 19 In the absence of a

2

Dpsbpkihsdharan Org

2 When there is no partnership deed prevails, the interest on loan of a partner to be paid @ 6% (May, 18 – 2 Marks) Answer 1 False According to the Indian Partnership Act, in the absence of any agreement to the contrary, profits and losses of the firm are shared equally among partnersIn the absence of Partnership Deed, the interest is allowed on partner's capital @ 5% pa @ 6% pa @ 12% pa No interest is allowed 26 In the absence of agreement, partners are not entitled to Salary Commission Equal share in profit Both (a) and (b) 27 In the absence of a partnership deed, the allowable rate of interest on partner In the absence of partnership deed, interest @ 6% pa will be allowed on partner's Loan Answer Answer True

Interest On

Class 12 Accounts Fundamental Of Accounts Notes

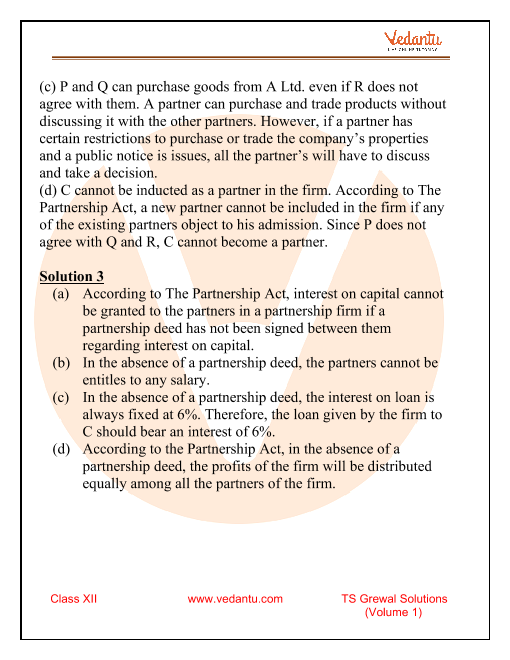

Interest on capital No interest on capital would be allowed to partners If there is an agreement to allow interest on capital it is to be allowed only in case of profits 3 Interest on capital No interest is allowed on the capital When a partner is entitled to interest on capital contributed as per partnership deed, such interest on capital will be payable only out of profits Section 13(c) Interest on loans advanced by partners to the firm Interest on the loan is to be allowed at the rate of 6 percent per annumSolution Question 2 Following differences have arisen among P, Q and R State who is correct in each case a

Ncert Solutions For Class 12 Accountancy Chapter 2 Accounting For Partnership

Visionglobalschool In

Accounting rules applicable in the absence of Partnership deed Normally, a partnership deed covers all matters relating to mutual relationship among the partners But, in the absence of agreement, the following provisions of the Indian Partnership Act, 1932 shall apply for accounting purposes 1 Interest on Capital No interest is allowed on Capitals of the Partners IfPartner's Salary No salary or commission will be given to any partner in the absence of partnership deed Interest on Partner's Loan Interest on partner's loan will be given @ 6% pa In case of partnership deed interest will be allowed at the agreed rate Important Points of a Partnership Deed The following points are to be mentioned in the partnership deed Name of the partners Name and nature of the business Capital contributed by each partner The ratio of Gain or Loss Rate of interest is allowed on a partner's capital Salary is to be paid to a partner for doing the extra job

Ravi And Tiku Are Partners In A Firm According To Their Partnership Deed I Interest On Capital Will Be Allowed 5 Per Annum Sarthaks Econnect Largest Online Education Community

Ggpsbokaro Org

In the absence of partnership deed, the interest on loan payable at is (a) 6% pa (b) 050% pa (c) 5% pa (d) 4% pa In absence of partnership deed (a) interest on capital is given (b) interest on drawings discharged (c) salary is given There may be a provision in the partnership deed that a particular partner or partners shallOnly 6% interest is allowed on a partner's loan when there is no partnership agreement (d) A and B having contributed larger amounts of capital, desire that the profits should be divided in the ratio of their capital contribution but C does not agree Interest on capital No interest on capital would be allowed to partners If tehre is an agreement to allow interest on capital it is to be allowed only in case of profits 3

Accountancy Test No 6 Class 12th Commerce With Nikhil Guru Facebook

Profit And Loss Appropriation Account Accountancy Knowledge

(D) when the partner's salary and interest on capital are not incorporated in the partnership deed Answer Answer A 18 In the absence of Partnership Deed, the interest is allowed on partner's capital (CPT; Aug 24,21 In the absence of any deed of partnershipa)Interest at the rate of 6% is to be allowed on a partner's loan to the firmb)Partners are entitled for commission @ 6% of the net profits of the firmc)Partners contributing highest capital is entitled for interest on capital @ 6% pad)Only working partners are entitled to SalaryCorrect answer is option 'D'In the absence of Partnership Deed, the interest is allowed on partner's capital (A) @ 5% pa (B) @ 6% pa @ 12% pa (D) No interest is allowed Answer D Ques In the absence of a partnership deed, the allowable rate of interest on partner's loan account will be (A) 6% Simple Interest (B) 6% pa Simple Interest 12% Simple

Ts Grewal Solution Class 12 Chapter 2 Accounting For Partnership Firms Fundamentals 19

A B C Are Partners In A Firm They Have No Partnership Agreement For Their Guidance At The End Of The First Of The Commencement Of The Firm Sarthaks Econnect

In the absence of partnership deed , what are the rules related to the following ayushi8462 ayushi8462 Accountancy Secondary School answered In the absence of partnership deed , what are the rules related to the following (a)interest on partners capital (b)profit sharing ratio (c)interest on partners loan Interest on capital No interest is allowed on the capital When a partner is entitled to interest on capital contributed as per partnership deed, such interest on capital will be payable only out of profits Section 13(c) Interest on loans advanced by partners to the firm Interest on the loan is to be allowed at the rate of 6 percent per annum Interest on drawings – No interest on drawings is charged from the partners Interest on Loans –Interest @ 6% pa is to be allowed on the loan given by the partners to the firm Right to participate in the conduct of the business – Each partner has the right to participate in the conduct of the business Admission of A new partner Admission of A new partner cannot

Interest On Loan Profit And Loss Appropriation Account Class 12 Accounts Video 4 Accountancy Youtube

Ts Grewal Solution Class 12 Chapter 2 Accounting For Partnership Firms Fundamentals 19

Interest must be payable @ 6% pa on loan and not on capital if deed is silent 7 Interest on Loan by the Firm to Partners If firm given loan to a partner, interest will be charged on the loan at the agreed rate Interest is not charged on such loan if Partnership deed is silentInterest on loan of a partner is allowed at the rate of 6% per annum in absence of Partnership Deed Concept Meaning and Definitions of Partnership and Partnership Deed Report Error In the absence of Partnership Deed, the interest is allowed on the loan given by the partners to the firm— (a) 9% per annum (b) 8% per annum (c) 6% per annum (d) 5% per annum 5 In the absence of Partnership Deed, the interest is allowed on the capital of the partner— (a) No interest is allowed

Accounting For Partnership Notes Class 12 Accountancy

Page 17 Ma 12

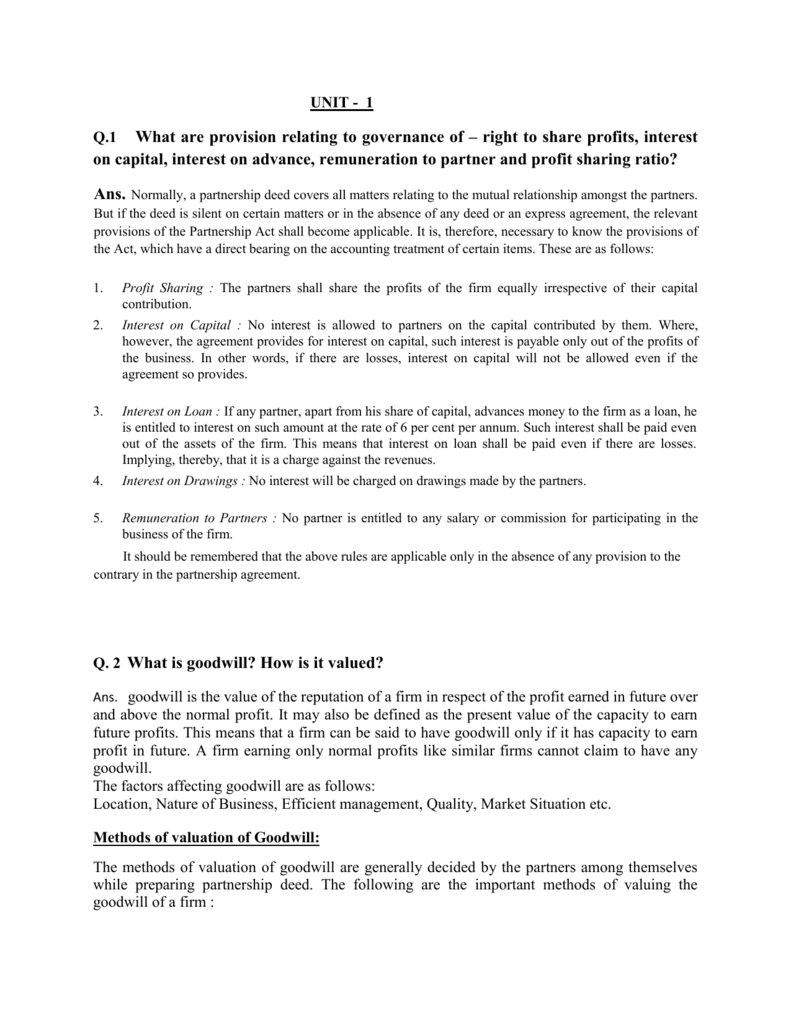

In the absence of Partnership Deed, what are the rules relation to (a) Salaries of partners, (b) Interest on partners capitals (c) Interest on partners loan (d) Division of profit, and (e) Interest on partners drawings Solution Question 2 Following differences have arisen among P, Q and R State who is correct in each caseMeaning of Partnership Deed 2 Contents of a Partnership Deed 3 Rules to be Followed in the Absence of a Partnership Deed Meaning of Partnership Deed The partnership comes in existence by an agreement The agreement may be written or oral But it is advisable that a Partnership Agreement or Partnership Deed is drawn up and signed by the

Hots Accountancy Class 12 Chapter 2 Accounting For Partnership Basic Concepts

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Cbse Tuts

Ts Grewal Solution Class 12 Chapter 2 Accounting For Partnership Firms Fundamentals 19

Cbse Class 12 Interest On Partners Loan Guarantee And Adjustments Offered By Unacademy

Partnership Accounting

Profit Academy Photos Facebook

Partnership Deed Contents Features Benefits All You Must Know

Ts Grewal Accountancy Class 12 Solutions Chapter 1 Accounting For Partnership Firms Fundamentals Ncert Books

Ts Grewal Accountancy Class 12 Solutions Chapter 1 Accounting For Partnership Firms Fundamentals Ncert Solutions

Jaspal And Rosy Were Partners With Capital Contribution Of Rs 10 00 000 And Rs 5 00 000 Respectively They Do Not Have A Partnership Deed Jaspal Wants That Profits Of The Firm Should Be Shared

Cbse Class 12 Rules Applicable In Absence Partnership Deed With Illustration In Hindi Offered By Unacademy

Digital Lesson On Accounting For Partnership Firms Fundamentals

Pankaj Wadhwani S Commerce Classes Is At Pankaj Wadhwani S Commerce Classes Facebook

2 Mahesh Ramesh And Suresh Are Partners In A Firm They Do Not Have A Partnership Deed At The End Brainly In

1

Accounting For Partnership Part 1

2

Ravi And Tiku Are Partners In A Firm According To Their Partnership Deed I Interest On Capital Will Be Allowed 5 Per Annum Sarthaks Econnect Largest Online Education Community

Images Topperlearning Com

Basic Commerce Questions 2 10 19 19 Basic Commerce Questions Studocu

Interest Remuneration To Partners Section 40 B

Jaspal And Rosy Were Partners With Capital Contribution Of Rs 10 00 000 And Rs 5 00 000 Respectively They Do Not Have A Partnership Deed Jaspal Wants That Profits Of The Firm Should Be Shared

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Cbse Tuts

Accountancy All India Set 2 14 15 Cbse Arts Class 12 Question Paper Solution Shaalaa Com

In The Absence Of Partnership Deed How Are The Following Matters Resolved 1 Interest On Loan By Partner S And Accountancy Accounting For Partnership Basic Concepts Meritnation Com

Freehomedelivery Net

Accountancy All India Set 3 14 15 Cbse Arts Class 12 Question Paper Solution Shaalaa Com

107 A Rules Applicable In The Absence Of Partnership Deed Accountancy Class 12 Youtube

Mcq On Basics Of Partnership Multiple Choice Questions And Answers Partnership Accounts Mcqs Cma Mcq

Accounting For Partnership Firms Fundamentals Part 1 Notes Edurev

Interest On Loan Profit And Loss Appropriation Account Class 12 Accounts Video 4 Accountancy Youtube

Partnership Accounting

Accounting For Partnership Firms Fundamentals Part 1 Notes Edurev

Partnership Deed Meaning Format Registration Stamp Duty

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Cbse Tuts

Accountancy 1 Pages 101 150 Flip Pdf Download Fliphtml5

Partnership Accounts

Mcq Questions Class 12 Accountancy Accounting For Partnership

Accounting For Partnership Notes Class 12 Accountancy

Solved Accountancy Practical Oriented Questions Section D 1 Prepare Opening Statement Of Affairs With 5 Imaginary Figures 2 Prepare Capital Accounts Of Two Partners Under Fluctuating Capital System With 5 Imaginary Figures

Mp Board Class 12th Accountancy Important Questions Chapter 2 Partnership Accounts Basic Concepts Mp Board Solutions

Cbse Class 12 Accountancy Accounting For Partnership Firms Fundamentals Notes Concepts For Accountancy Revision Notes

Can Partnership Firm Give Loan To Partners Loan Contract

Accounting For Partnership Notes Class 12 Accountancy

Page 30 Debk Vol 1

Dtp Nwldlbgl1m

In The Absence Of Partnership Deed Youtube

Ts Grewal Solutions Archives Page 3 Of 5 Ncert Books

Accountancy All India Set 1 14 15 Cbse Arts Class 12 Question Paper Solution Shaalaa Com

The Absence Of Partnership Deed A Partner Is Entitled To Interest

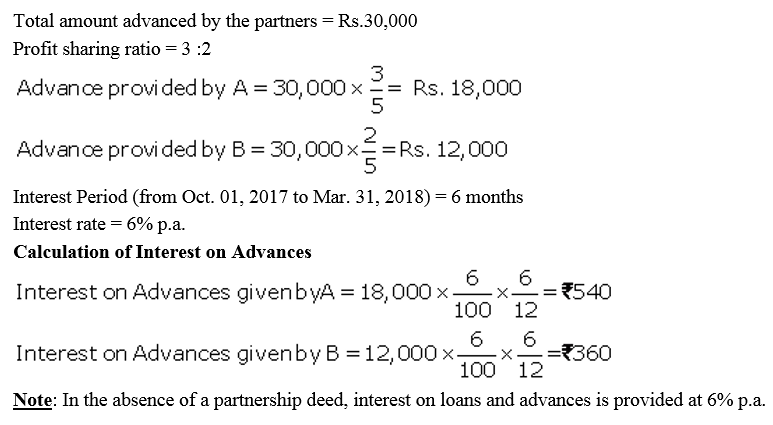

A And B Are Partners In A Firm Sharing Profits In The Ratio Of 3 2 They Had Advanced To The Firm A Sum Of Rs 30 000 Sarthaks Econnect Largest Online Education Community

Partnership Deed Contents Features Benefits All You Must Know

Partnership Deed Q 1 Q 6 Ch 2 Ts Grewal S 21 Class 12th

1

Hots Accountancy Class 12 Chapter 2 Accounting For Partnership Basic Concepts

A And B Are Partners From 1st April 15 Without Any Partnership Agreement And They Introduce Capitals Of Rs 35 000 And Rs 000 Respectively Sarthaks Econnect Largest Online Education Community

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Accountancy

Cyd Tutorials Sarika Coaching Center Learn And Grow Facebook

Accounting For Partnership Notes Class 12 Accountancy

Partnership Deed Q 1 Q 6 Ch 2 Ts Grewal S 21 Class 12th

Capitalcoaching In

No Partnership Deed Exist Absence Of Partnership Deed Partners A And B Have Contacted You To Solve Brainly In

Udaylakhani Images Prof Uday Lakhani Sharechat ભ રતન પ ત ન ભ રત ય સ શ યલ ન ટવર ક

Plus Two Accountancy Part 1 Text Book Pdf Pages 101 150 Flip Pdf Download Fliphtml5

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Cbse Tuts

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Cbse Tuts

State The Provisions Of Partnership Act 1932 In Absence Of Partnership Deed Regarding 1 Interest On Partners Drawings And 2 Interest On Accountancy Accounting For Partnership Basic Concepts Meritnation Com

Q 1 What Are Provision Relating To Governance Of Right To Share

Brainery Of Commerce Posts Facebook

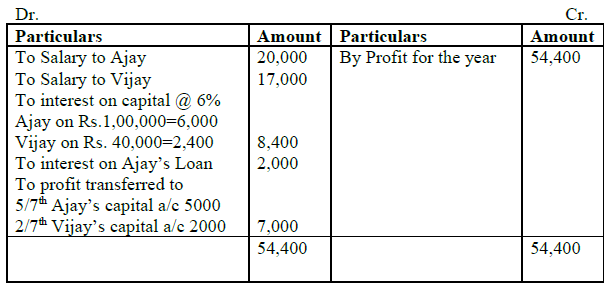

Important Questions For Cbse Class 12 Accountancy Profit And Loss Appropriation Account

Ts Grewal Solution Class 12 Chapter 2 Accounting For Partnership Firms Fundamentals 19

Remuneration To Partners In Partnership Firm Under 40 B

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Cbse Tuts

Class 12 Accounts Fundamental Of Accounts Notes

Class 12 Accountancy Part 19 Youtube

Ts Grewal Solutions Class 12 Accountancy Volume 1 Chapter 2 Accounting For Partnership Firms Fundamentals

Provisions Of Partnership Deed Indian Partnership Act 1932

Partnership Deed Contents Features Benefits All You Must Know

1

Partners Loan Account With Interest Thereon Assignment Point

Partnership Deed Its Importance And Rights Of Partners Accounting Finance

Partnership Deeds Meaning Contents With Solved Questions

Cbse Class 12 Rules Applicable In Absence Partnership Deed With Illustration In Hindi Offered By Unacademy

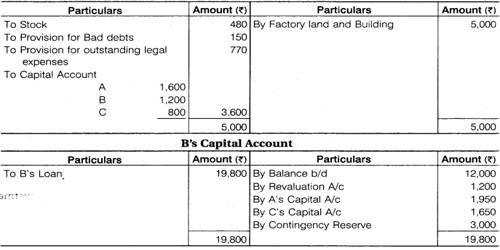

D Asset Account Ne On Dissolution Partners Loan Is Transferred To A Partners Capital Account By